Market is now closed 'till Mon 4th Jan.

No new positions were triggered this week though I was watching around 40 stocks for an entry.

TPM hit an exit and will be sold in the P Taker portfolio on Monday, which will bring the closed trades in that portfolio into positive territory for the first time.

P Hybrid will sell half the TPM holding & let the other half run with a wider exit.

P Runner will hold onto TPM with a wider exit.

Thursday, 31 December 2009

Saturday, 26 December 2009

Open Positions 24th Dec '09 End of Week

P Taker

P Hybrid

P Runner

There are no new closed positions, my market switch is ON so I'll look for another position to open next week.

Merry Christmas everyone & I hope you all had a sunny Solstice.

Thursday, 24 December 2009

Xmas Market Hours

| Public Holiday | Date | Applies to the following States | Trading Day1 | Settlement Activity - ASTC (CHESS) | Settlement Activity - ACH (DCS) | Bus. Day2 |

|---|---|---|---|---|---|---|

| Last Business Day before Christmas Day | Thursday 24 December | ALL | CLOSE EARLY21 | Settlement - ASTC | Settlement - ACH | YES |

| Christmas Day | Friday 25 December | ALL | CLOSED | No Settlement - ASTC | No Settlement - ACH | NO |

| Boxing Day | Monday 28 December | ALL | CLOSED | No Settlement - ASTC | No Settlement - ACH | NO |

| Last Business Day of the Year | Thursday 31 December | ALL | CLOSE EARLY 22 | Settlement - ASTC | Settlement - ACH | YES |

Monday, 21 December 2009

Buys & Sells Mon 21st Dec '09

Bought 4980 RSG @ $1.00 for all 3 portfolios

($5000.00 - $19.95 = $4980.05 = 4980 shares @ $1.00 Total cost = 4980+19.95=$4999.95)

Mon Buys & Sells

Bids in for RSG @ 1.00 & TPM @ 1.675

Just discovered SOT has changed it's code to TPM and has been trading as TPM since early Dec, so I've cancelled the TPM bid!

| name changed to TPG Telecom Limited | 07/12/2009 |

| the suspension of trading in the securities of SOT will be lifted immediately, following the release of an announcement of the proposed deal with Pipe Networks (PWK) whereby SOT will acquire all PWK shares for $6.30 cash a share | 11/11/2009 |

Will now have to re-do the open positions, but the bonus is that TPM closed at 1.74 compared to last close in SOT at 1.63

Updated Open Positions for 18th Dec '09

P Hybrid

P Runner

Sunday, 20 December 2009

Open Positions 18th Dec '09 End of Week

P Taker

P Hybrid

P Runner

ASX Market switch is now ON so I'll look to enter another position next week.

Monday, 14 December 2009

Sunday, 13 December 2009

EOW 11th Dec '09 Open Positions

End of Week 11th Dec '09 Open Positions

P Taker

P Hybrid

P Runner

CER hit the exit in all 3 portfolios & will be sold at the open on Monday 14th Dec

No new positions to be taken next week as my Market Switch is OFF

Monday, 7 December 2009

Sunday, 6 December 2009

EOW Open Positions

End Of Week Open Positions

P Taker

P Hybrid

P Runner

CGG and SXE hits their exits this week, so will be sold Monday 7th Dec on open.

No new positions will be taken next week as my Market Switch is off.

Monday, 30 November 2009

Sunday, 29 November 2009

Frriday 27th Results

CNP closed below it's exit on Friday and will be sold in the opening auction Monday 30th

P Taker

P Hybrid

P Runner

Tuesday, 24 November 2009

I'm starting up another portfolio which is going to be run along the same lines as the P Hybrid portfolio but will have a nominal 20 positions instead of 10.

This means that the theoretical starting capital will have to be $100k instead of $50k as the individual positions will be the same size ie $5k.

In order not to complicate this blog which has already got 3 portfolios running on it, I'll start another blog to compare the two portfolios with different number of positions.

This is to test the theory that a 20 position portfolio is twice as likely to catch the rockets as a 10 position portfolio.

Hybrid20 portfolio is here http://hybrid20.wordpress.com/

This means that the theoretical starting capital will have to be $100k instead of $50k as the individual positions will be the same size ie $5k.

In order not to complicate this blog which has already got 3 portfolios running on it, I'll start another blog to compare the two portfolios with different number of positions.

This is to test the theory that a 20 position portfolio is twice as likely to catch the rockets as a 10 position portfolio.

Hybrid20 portfolio is here http://hybrid20.wordpress.com/

Friday, 20 November 2009

Friday 20th November

No exits hit this week, the XAO fell 0.34%, P Taker fell 1.52%, P Hybrid fell 1.48%, and P Runner fell 1.45%

P Taker

P Runner

Thursday, 19 November 2009

Bought CNP yesterday @ 0.31, so with CER that's enough Real Estate exposure.

Portfolio heat is now a nominal 6% so I shan't take on any more risk, even though there is capital available, until another holding gets it's exit above the purchase price.

Here is a list of the Holdings with Indices and Sectors;

CER Small Ords Real Estate

CGG Small Ords Materials

CNP Small Ords Real Estate

(HZN Small Ords Energy)

MCP All Ords Consumer Discretionary - Consumer Durables & Apparel

(SFH All Ords Consumer Discretionary - Retailing)

SOT All Ords Telecommunication Services

SXE All Ords Industrial - Capital Goods

Bracketed stocks not in P Taker Portfolio

All the above stocks are in theP Hybrid and P Runner portfolios.

Looking forward to having enough closed trades to have some statistics..

Portfolio heat is now a nominal 6% so I shan't take on any more risk, even though there is capital available, until another holding gets it's exit above the purchase price.

Here is a list of the Holdings with Indices and Sectors;

CER Small Ords Real Estate

CGG Small Ords Materials

CNP Small Ords Real Estate

(HZN Small Ords Energy)

MCP All Ords Consumer Discretionary - Consumer Durables & Apparel

(SFH All Ords Consumer Discretionary - Retailing)

SOT All Ords Telecommunication Services

SXE All Ords Industrial - Capital Goods

Bracketed stocks not in P Taker Portfolio

All the above stocks are in theP Hybrid and P Runner portfolios.

Looking forward to having enough closed trades to have some statistics..

Wednesday, 18 November 2009

Tuesday, 17 November 2009

Monday, 16 November 2009

Sunday, 15 November 2009

P Hybrid has had the same buys and sells as P Taker but only half the number of shares have been sold.

P Taker Open Positions

P Taker Closed Trades

P Hybrid Closed Trades

P Runner Closed Trades

The P Hybrid portfolio has a total open equity of $56733.98 which is approx halfway between P Taker's $56176.56 and P Runner's $57331.25 (The difference is half the cost of 2 brokerage fees)

Thursday, 12 November 2009

Then there were 3

It occurred to me that as one weekly portfolio adheres to the principle "You'll never go broke taking a profit" and the other weekly portfolio is testing the "Let your profits run" principle, it seems likely that one will perform better in certain market conditions than the other, and as the market is constantly changing it's possible that a hybrid of the two might perform best overall.

So to test that theory I'll be starting a third portfolio which will be identical to the other two portfolios except for the exit, where if a sell signal occurs, half the position will be sold to take some profit and half will be kept to let profits run. I will call this new portfolio P Hybrid, although P Soup and P Stew were tempting alternatives :)

So to test that theory I'll be starting a third portfolio which will be identical to the other two portfolios except for the exit, where if a sell signal occurs, half the position will be sold to take some profit and half will be kept to let profits run. I will call this new portfolio P Hybrid, although P Soup and P Stew were tempting alternatives :)

Wednesday, 11 November 2009

Friday, 6 November 2009

8 weeks from start

Results 06//11/09

Profit Taker portfolio

Profit Taker portfolio

SFH, THG and VBA hit their weekly exits and will be sold at the open on Monday 09/11/09.

Profit Runner portfolio

In this portfolio only THG and VBA will be sold on Monday's open.

The All Ords is up from 4596.5 to 4604.4 for the 8 weeks which is a 0.17% increase.

The P Taker portfolio is up 7.5% and P Runner is up 8.5% over the same period.

Monday, 2 November 2009

Portfolio split

I'm going to duplicate the current stocks in the weekly portfolio and start another weekly portfolio with a different exit strategy.

One that will not be as quick to sell but should hold positions longer.

This will give an interesting comparison between two portfolios, one where profits are taken and the other where profits are left to run.I would expect that in the short term the profit taker portfolio will do better, but in the long run the profit runner portfolio should do the best out of the two.

So today 2 stocks FMS and HZN were sold in the P Taker portfolio at the open, but in the P Runner portfolio only one (FMS) was sold, and HZN was kept.

This blog has now changed from a simple record of trades in one portfolio to a comparison of two trading methods, taking profits and letting them run.

Friday, 30 October 2009

Tuesday, 27 October 2009

The Start

This blog is a forward test of a weekly trend following method.

The universe is the ASX All Ords which is scanned and filtered once a week to around 30 or 40 candidates.

So far this portfolio has been monitored on the backs of old envelopes, so this blog is an attempt to tidy things up and get all the info about these trades organised and in one place.

Starting capital $50,000 and started taking positions on 14th Sept '09

This is the position at the close on Tues 27/10/09

There are no buys for this week as the portfolio is now fully invested.

Positions will be evaluated again at the end of the week to see if any exits have been triggered, if so they will be sold at the open on Monday 02/11/09

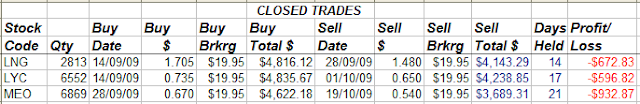

These are the closed trades to 24/10/09

The universe is the ASX All Ords which is scanned and filtered once a week to around 30 or 40 candidates.

So far this portfolio has been monitored on the backs of old envelopes, so this blog is an attempt to tidy things up and get all the info about these trades organised and in one place.

Starting capital $50,000 and started taking positions on 14th Sept '09

This is the position at the close on Tues 27/10/09

There are no buys for this week as the portfolio is now fully invested.

Positions will be evaluated again at the end of the week to see if any exits have been triggered, if so they will be sold at the open on Monday 02/11/09

These are the closed trades to 24/10/09

No profitable trades have been closed out yet.

Stocks will normally be sold on Monday at the open, with the exception of stocks like LYC which had a share dilution and was sold as soon as it came out of the trading halt.

Subscribe to:

Comments (Atom)